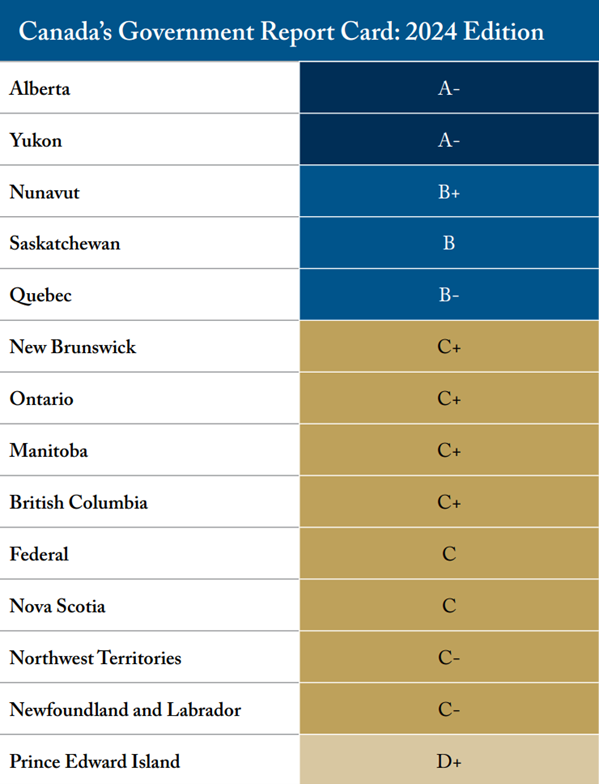

The C.D. Howe Institute's latest report card on the financial transparency of Canada's federal, provincial and territorial governments is now out, revealing stark contrasts among these governments. The report card ranks the senior governments on fiscal accountability. Alberta and Yukon lead the pack with A- grades. Prince Edward Island trails with a D+.

In "Fiscal Accountability by the Letters: The Report Card for Canada's Senior Governments, 2024," William B.P. Robson and Nicholas Dahir assess governments' transparency and accountability based on the accessibility, reliability, and timeliness of their budgets, estimates, and financial statements.

"Our report card is a call to improve fiscal transparency and strengthen public trust," Robson says. "Governments are responsible for stewarding public funds on behalf of Canadians. Understanding how they manage those funds should not be a struggle. This report card gives Canadians a straightforward tool to evaluate how well governments let legislators and voters understand their fiscal plans and hold governments to account for fulfilling them."

Alberta and Yukon topped the class in 2024 due to their timely releases, consistent accounting, and clear presentations. Both governments presented key figures early in their documents and released frequent in-year updates, allowing citizens and legislators to track fiscal performance against projections.

In the mid-tier, Saskatchewan and Nunavut earned B and B+ grades, demonstrating generally good practices, though with occasional gaps in consistency and timeliness. Quebec earned a B- grade, while Ontario, British Columbia, Manitoba, and New Brunswick received C+ grades, reflecting the need for improvement in meeting best practices for financial transparency.

The federal government and Nova Scotia received middling Cs. For Ottawa, issues such as key figures buried hundreds of pages deep in the federal budget and inconsistent accounting in its main estimates obscure the view of total federal spending and taxation.

Robson and Dahir also highlight significant challenges lower-ranked governments face, with Newfoundland & Labrador and Northwest Territories receiving C- grades and Prince Edward Island receiving a D+. Delays in releasing financial statements and large discrepancies between projected and actual change in net worth contributed to these lower scores.

Robson and Dahir note positive changes over time - notably greater adoption of Public Sector Accounting Standards across governments, bringing more consistency in reporting practices. However, challenges remain, particularly ensuring the timely release of year-end financial statements and clear presentation of the key fiscal numbers in budgets.

The authors provide a preview of 2025 scores, with Alberta expected to retain its leading position, while Quebec and Nunavut are on track for B+ grades, and Ottawa is on track for a C-. The authors caution that improvements in fiscal accountability require continued attention and effort.

"Transparent financial reporting is more than a best practice; it's a democratic responsibility," says Dahir. "Clear, accessible, and timely information helps Canadians understand how their tax dollars are being spent and helps them to hold their governments accountable."